Apple has become only the third publicly traded company in history to briefly crack the $4 trillion market value milestone, joining fellow technology titans Nvidia and Microsoft.

The achievement, reached on Oct. 28 marks a significant reversal of fortune for the iPhone maker, whose stock had lagged earlier in the year over fears of a slow artificial intelligence (AI) strategy.

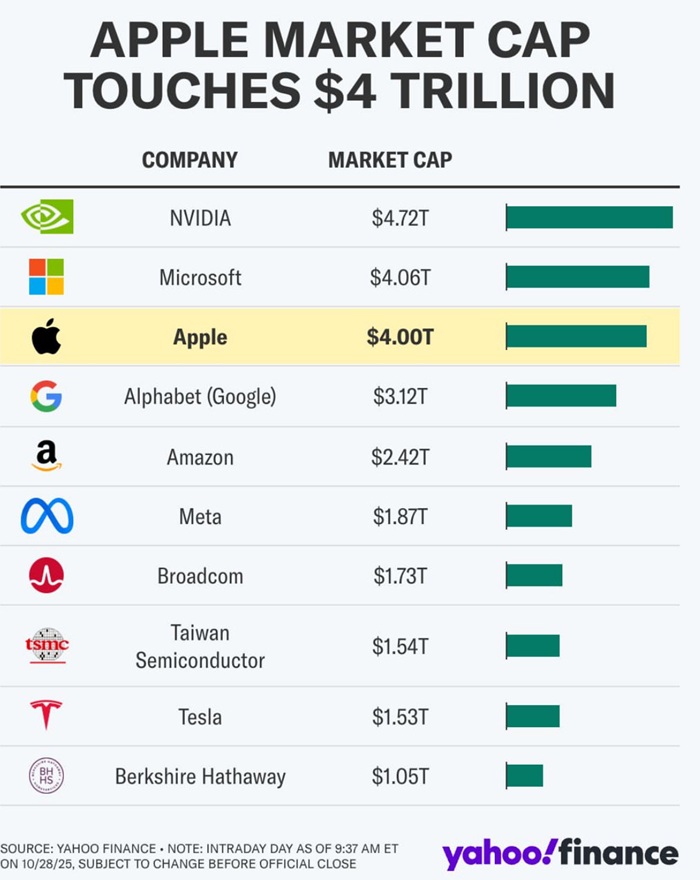

Apple shares rose fractionally in early trading to briefly push the company’s value above the historic level, hitting a peak of $4.005 trillion when the stock reached $269.89. The company subsequently receded to close the trading day at $3.99 trillion, representing a 0.1% gain. The milestone was first crossed by AI chip provider Nvidia and cloud giant Microsoft in July. Nvidia remains the most valuable company in the world, with a market valuation hitting $4.88 trillion as of Tuesday’s close, while Microsoft’s value rose above the benchmark again to $4.03 trillion.

iPhone 17 success

The rebound, which saw Apple’s stock rally more than 56% from its April low and gain 25% over the past three months, is largely attributed to the robust global launch of the iPhone 17 lineup in mid-September. The success of the newest models—including the extra-slim iPhone Air which sold out in minutes in China—has allayed concerns that the company’s flagship product may have lost its momentum.

Early sales data underscored this resurgence. Research firm Counterpoint reported that early sales of the iPhone 17 outperformed its predecessor by 14% in the U.S. and China. Wall Street analysts quickly updated their outlooks on the company.

Analysts at Evercore ISI wrote on Monday, “Our checks suggest this may be more than the average iPhone refresh cycle, as lead times for the base iPhone 17 continue to outpace last year’s levels. In addition, our survey work points to a strong demand environment.”

Wedbush Securities analyst Dan Ives acknowledged the product’s success while keeping the focus on future strategy: “It’s clear to us that (CEO Tim) Cook & Co. has finally found success with iPhone 17 and now the Street awaits for the grand strategic AI roadmap to be unveiled.” Mr. Ives also called the crossing of the threshold a “watershed moment for Cupertino and Big Tech and a testament to the best consumer franchise in the world,” despite the company “missing out on AI so far.”

AI Strategy and Market Dynamics

Despite the record valuation, Apple’s stock performance this year is still trailing its major technology peers. Apple has gained just 7.5% in 2025, well behind Nvidia’s 50%, Alphabet’s 42%, and Meta Platforms’ 28%. This divergence highlights Wall Street’s current focus on artificial intelligence, where Apple is perceived to be falling behind.

Chris Zaccarelli, chief investment officer for Northlight Asset Management, summarized the company’s market driver and the chief concern: “The iPhone accounts for over half of Apple’s profit and revenue and the more phones they can get into the hands of people, the more they can drive people into their ecosystem. . . The lack of a well-understood artificial intelligence strategy is clearly one of the things that is an overhang for the stock. If they could figure out how to incorporate artificial intelligence in a way that would excite consumers and the market, you’d see a whole different company.”

The market’s intense focus on AI is further evidenced by the fact that Nvidia and Microsoft, a critical AI chip provider and a major player in the cloud market, respectively, both beat Apple to the $4 trillion milestone.

Navigating trade and geopolitics

In addition to strong sales, the stock benefited from two key external developments. First, a federal judge ruled in early September that Google could continue to pay Apple billions of dollars a year to have its search engine preloaded on iPhones.

Second, the company appears to have successfully mitigated geopolitical trade risks. Throughout President Donald Trump’s trade war, most Apple products have been exempt from tariffs. JPMorgan analyst Samik Chatterjee noted that the company has improved its positioning in this landscape: “Announcement of an increased pace of domestic investment in combination with a rapid shift in product manufacturing for the US market outside of China (India, Vietnam) has improved Apple’s positioning in the tariff landscape.”

Apple’s CEO Tim Cook has also maintained a highly visible relationship with the administration, including multiple visits to the Oval Office and an appearance with President Trump in Japan on Tuesday, October 28.

Apple quarterly sales up 8%

The positive sentiment was further solidified when the Cupertino-headquartered tech giant announced its fourth-quarter results on Oct. 30. For this quarter, Apple saw earnings per share (EPS) of $1.85 on revenue of $102.5 billion. Apple’s iPhone business brought in $49.03 billion in revenue, shy of expectations of $49.3 billion. “Our September quarter results capped off a record

“Today, Apple is very proud to report a September quarter revenue record of $102.5 billion, including a September quarter revenue record for iPhone and an all-time revenue record for Services,” Tim Cook said. “In September, we were thrilled to launch our best iPhone lineup ever, including iPhone 17, iPhone 17 Pro and Pro Max, and iPhone Air. In addition, we launched the fantastic AirPods Pro 3 and the all-new Apple Watch lineup. When combined with the recently announced MacBook Pro and iPad Pro with the powerhouse M5 chip, we are excited to be sharing our most extraordinary lineup of products as we head into the holiday season.”

Tim Cook offered an upbeat forecast on the the company’s earnings call, saying the company expects the December quarter’s revenue to be “the best ever for the company and the best ever for iPhone.”

"We expect the December quarter's revenue to be the best ever for the company and the best ever for iPhone," Apple CEO says during $AAPL's Q4 earnings call. pic.twitter.com/e1Rnuw4yLV

— Yahoo Finance (@YahooFinance) October 30, 2025